Welcome to our first quarterly round-up of 2021! If you’re new here, every quarter we compile the top e-commerce and digital marketing news our team is talking about. We frequently highlight updates to Google Shopping, Google Search, Amazon Advertising, and Paid Social platforms—and our expert analysts share their thoughts on the impact of these updates. In this review of Q1 2021 e-commerce news, we’ll take a look at Australia’s latest legislation regarding news online, new laws in Maryland and Virginia, and updates from both Google and Amazon.

1) Google and Facebook Must Pay for News in Australia

This quarter, the saga of Facebook, Google, and Australia evolved. It all started with Australia passing a new law requiring big tech companies, like Facebook and Google, to pay publishers for news content. If Google wants to show news articles in search results—then they will have to pay those publishers.

Google had been pushing against the law for a while and suggested they might pull out of Australia altogether. However, after the law passed Google signed agreements with a few publishers so they could continue operating.

Facebook, on the other hand, immediately blocked all news following the passing of the law. Facebook then stated that they would restore the removed news pages after Australia made changes to the law. Finally, Facebook signed a deal with the publisher Seven West Media.

It was quite the roller coaster of events—ending with both Facebook and Google agreeing to sign deals with publishers. Will other countries also follow suit?

SEM Analyst: Chris Kendall

“The weeks leading up to the recently-enacted News Media Bargaining Code in Australia have not been without controversy. Google threatened to shut down service in Australia if the original wording of the bill became law; Microsoft stated that it would be happy to expand its Bing presence in the Australian market if Google followed through with this threat. For a few days, Facebook removed the ability to publish or share news on its Australian site.

The lengths these tech giants were willing to go to fight this law should illustrate to marketers the dangers of dependence on a single platform. This is important to keep in mind as similar pieces of legislation are being considered in other countries.”

2) Maryland Taxes Big Tech & Virginia Passes Privacy Laws

Stateside, Maryland and Virginia are moving forward with legislation impacting online marketing.

This quarter, Maryland passed the first tax on Big Tech ad revenue. The tax will be based on the ad sales a company generates. If a company makes from $100 million to $1Billion a year in global revenue they will be taxed 2.5% on ads. Companies that make more than $15Billion a year will be taxed 10% on ads. Groups representing Amazon, Facebook, and Google immediately began to lobby against the tax.

Virginia, on the other hand, is aiming to increase user privacy with their new Consumer Data Protection Act (CDPA). Starting in 2023, the CDPA will grant Virginia consumers these rights:

- To confirm if a data controller is using their personal data or not

- To access, correct, and even delete their personal data that a controller has

- To get a copy of their data they’d provided their data to the data controller

- To opt out of having their personal data processed for targeted advertising

SEM Strategist: Elizabeth Kanarek

“While some European countries have already created taxes on online advertising, Maryland’s ad revenue tax will be the first of its kind in the US. There will be a lot of questions posed on how these tax laws interact with interstate commerce laws and how much they will be able to tax. With the Big Tech lobbying groups already suing the state, there will be a long legal battle ahead of them both. If this tax comes to fruition, I wouldn’t expect it to be enacted for some time from now.

Virginia’s new data privacy legislation is following in the footsteps of the EU’s GDPR data privacy restrictions. There’s a good chance Big Tech will try and fight back against this as well and discourage other states to implement similar legislation”

3) Google Q1 2021 Updates

Google has rolled out plenty of updates so far this year.

On Google Shopping, Google is currently testing a shopping option when you open a new tab called “Chrome Cart”. If you use buy on Google, you can use a new feature that automatically adjusts your pricing based on rules you set in Merchant Center.

If you use Smart Shopping campaigns, you’ll have access to a new customer conversion goal. Finally, Google is taking price enforcement a step further and will now be tracking prices that are higher at check out than list pricing.

In search, Google has added a “Price Drop” text in rich search results. Now, if you lower your product’s price, you may get this rich text to appear in your search results.

SEM Strategist: Cody Franko

“While it appears to still be in the developmental stage, Google introducing a widget like Chrome Cart could have a profound impact on Google Shopping and how consumers interact with PLAs. The ability to access a saved cart and potentially check out all from the new tab page will streamline the process for many and could lead to increased conversions across the board.”

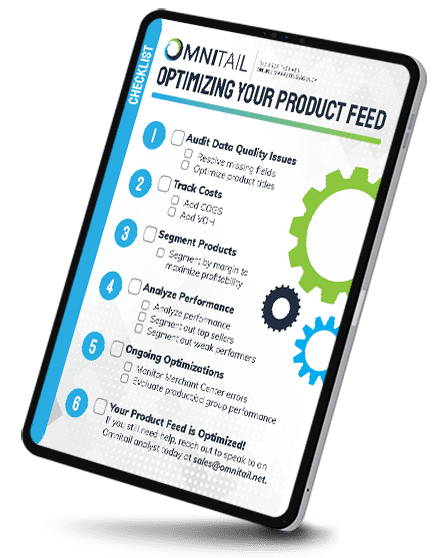

As for Google enforcing price accuracy at checkout, this only increases the importance of having an optimized products feed. As we know, price changes are not uncommon and if the proper processes are not in place to address dynamic pricing, retailers could potentially miss out on advertising key revenue-driving products.”

4) Amazon Q1 2021 Updates

Amazon has also had a busy quarter. Jeff Bezos stepped down as CEO in February and was replaced by Andy Jassy—following Amazon’s first $100 Billion quarter in Q4 of 2020.

These changes haven’t stopped Amazon from releasing updates. In Q1, Amazon improved product targeting for Sponsored Display campaigns. They also removed the product optimization feature for Sponsored Brands—as well as the review comment feature.

Senior SEM Analyst: CJ Milhoan

“To start the year Amazon released and, in some cases, removed various features within their marketplace/Seller Central. One of the smaller changes relates directly to Sponsored Brands. Amazon will no longer optimize various products outside of the “Product collection” you originally set up to be displayed. This means going forward you’ll need to ensure the proper products are advertised within proper campaigns, as you want to make sure top-selling items are garnering impressions.

Another change you should know about if you sell within the Dietary & Supplements category: Amazon is crunching down on products that might not be safe for consumers. If you sell in this category, you’ll need to receive a Certificate of Analysis (CoA), essentially, you’ll need to have your products analyzed by a laboratory or you can appeal this requirement. Furthermore, products will now require a guarantee from the manufacturer and products must have images that show essential product information e.g., nutritional facts, etc.

One of the biggest changes impacting a lot of sellers in early February was that Amazon changed the terms to Seller Fulfilled Prime (SFP). In short, these changes mean that SFP retailers need to be able to meet one/two-day delivery (a key value prop for Amazon), sellers must use shipping methods that allow them to ship over the weekend (which can be burdensome for those organizations that don’t operate over the weekend), and the seller must have nationwide delivery (lower 48 states). This change is huge. If you’re a retailer who has SFP, losing this designation can significantly lower your ability to drive sales as if you cannot adhere to the above standards you stand to lose “Prime” eligibility on your items/store.

It’s important to stay informed regarding these trends, as they impact not just the advertiser but also the retailer/seller. It’s highly recommended that if you are impacted by these that you speak with your team about how to resolve these issues or overcome them.”

5) Google’s Solution to Getting Rid of Cookies

As privacy becomes a bigger concern online across the globe, cookies are falling to the wayside. Reflecting on this change, Google introduced an alternative solution to third-party cookies. It’s called Federated Learning of Cohorts (FLoC).

Marketing Manager: Christina DiSomma

“Browsers are leaving cookies behind, and that’s left advertisers wondering how they’ll attribute sales in the future. Google’s answer to this is Federated Learning of Cohorts (FLoC), which groups people with the same interests, demographics, etc into a cohort so advertisers can serve ads without sacrificing the privacy of individuals. Google estimates FLoC will cover 95% or more of sales, but it remains to be seen how much of a gap cookies will leave in attribution data.

Marketers and advertisers should get ahead of this trend now. Google Analytics 4 represents more privacy-minded analytics from Google. It’s wise to configure a GA4 property as soon as possible as there is already a data gap present in Universal Analytics. A cookie-less future may not be here yet, but it’s not far over the horizon.”

That’s it for 2021 Q1 e-commerce news. What updates are impacting your business? Let us know here.