Segment Your Product Listing Ads: Using Keywords in Google Shopping

Through the course of testing many popular PLA strategies in the last few years, we have found that segmenting product listing ads by the intent of the users’ search has yielded the most radical improvements in profit for our clients.

In this post, I will explain exactly what “segmenting for query intent” means. Then, we will look at how you can segment product listing ads for query intent. Next, I will provide some examples which illustrate why this strategy is so important and how much value it can contribute to a business.

To put it simply, retailers who do not segment product listing ads by query intent are at a competitive disadvantage in their marketplace, as they are unable to optimally invest their media budget.

What Does “Segmenting for Query Intent” Mean?

Segmenting PLAs for the intent of the users’ query means, in short, streamlining the way your marketing investment is distributed, across search queries, with the return which those queries are likely to yield based upon the probability of a shopper to purchase.

Akin to an investment portfolio, some investments yield greater returns than others. If you’re a search marketer, then you’re aware that some keywords or search queries yield greater returns than others. Different keywords and search queries often hold different values to a business. Since clearly not all queries hold the same value, it is critical to segment product listing ads in order to maximize the return on your investment.

The Consumer Purchase Decision Process and Search Queries

To illustrate why, let’s take a trip back to Marketing 101, where we learned that consumers generally follow the same steps on their path to purchase, progressing from need recognition, to seeking information, to evaluating alternatives and then finally making their purchase decision.

It’s no secret that consumer search behavior mirrors the consumer purchase decision process, with shoppers typically progressing from generic queries such as “Men’s Tennis Shoes” to brand-specific queries i.e. “Nike Men’s Tennis Shoes” and then onto product-specific queries such as “Nike Men’s Zoom Vapor Tennis Shoe” or “Nike Men’s Shoe 631458” before making a purchase.

This behavior syncs perfectly with the purchase decision process – you can think of this as a funnel. The shoppers searching for a generic query are generally less qualified, less likely to convert, and not the best user segment for you to invest in.

Progressing down the funnel, brand-specific queries indicate a user has a brand of products in mind, and is a bit more qualified to make a purchase. Finally, you have users who search for an exact product, whether it be the name of the product, a product family, a style number, MPN or SKU id, UPC code, etc.

While you will need to confirm this with your data, we generally observe these users convert at the highest rate, as they are highly qualified shoppers, though results vary across retail categories, such as apparel.

The Value of Segmenting PLAs By Query Intent

Here’s an example, with anonymized data, which illustrates how PLA queries hold radically different values to a business. For this example we evaluated 11 months of data prior to actively segmenting product listing ads for query intent (before this retailer became our client).

For this particular account, we determined intent based upon whether the search pertained to a product or product family (product-specific), a brand but not a product (brand-specific), or did not relate to a brand or product (generic) – though for some industries, you may choose a different form of categorization.

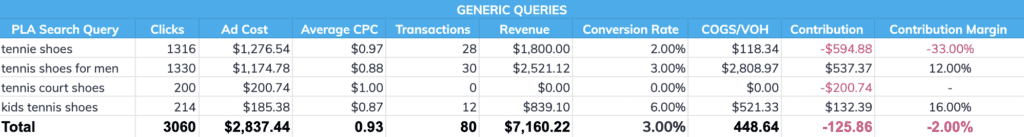

Generic Query Performance

Here’s a sample of generic query performance. As you can see below, generic PLA queries in this sample converted at an average of 3% for this business. That’s not necessarily a bad conversion rate, but the problem here is the average CPC, in this case at $0.93, which based upon the profit KPIs, is more than they are typically worth.

Without isolating generic queries in their PLA structure, this retailer was unable to reduce average CPC to a level where they generated profit, without also reducing bids and sales from their product-specific and brand-specific query segments.

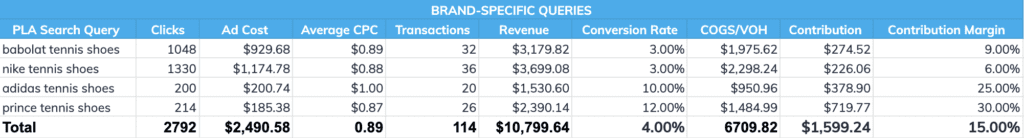

Brand-Specific Query Performance

Now take a look at the performance of brand-specific queries. These shoppers, who have a sense of what brand they are likely to purchase, convert at a slightly greater rate: 4%. Average CPC remains similar to the generic query segment, however the revenue generated per click (RPC), $3.87, is 66% greater than the RPC of the generic query sample. That’s enough to make brand-specific queries profitable for this retailer, despite the similar CPC.

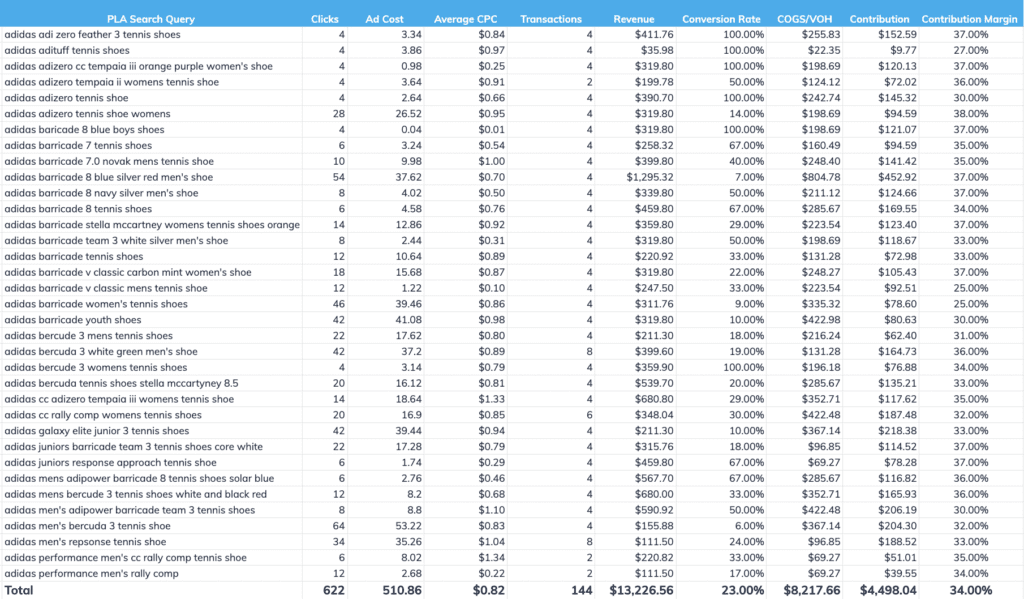

Product-Specific Query Performance

Finally, take a look at the performance of this sample of product-specific queries. These are all unique searches which pertain to a specific product or product family. These shoppers either have a very good idea which product they are going to buy, or know exactly which product they are going to buy, and are highly qualified shoppers. Consequently, these shoppers convert at a much higher rate – 23% for this retailer.

Again, average CPC is similar, at $0.82, however revenue per click (RPC) averages $21.26 – 812% greater than the RPC of the generic queries. As a result, these product-specific PLA queries are highly profitable for this retailer. In this case, this retailer was actually underinvesting in product-specific queries.

It’s evident that the range of search queries within our “PLA search query portfolio” yield radically different returns for this business – it is likely your business faces a similar scenario, though this can be confirmed by analyzing your historical search query data (we can do this for you).

But so what? What does this mean for your PLA channel? How can you act upon this information? I’ll cover that in the next two sections.

The Problem With Product Listing Ads

Product Listing Ads, whether they run on Google or Bing, all currently suffer from the same problem – they do not allow the advertiser to easily divert their ad spend by query in order to spend more on valuable queries, and spend less on inefficient queries.

No Control Over Which Products Show on Which Queries

Because PLA ad placement is determined by the probability of a match between a user search query and product feed attributes, and do not utilize keywords, this results in the same product being served to many different types of queries.

So when a user searches for a generic query such as “men’s shoes,” advertisers essentially serve product ads at random, as the user made no indication of what product, other than a top-level product category, that they are interested in.

Even if the product served is one which is a top-performer, a product the shopper previously viewed on the website, etc. the advertiser has no idea what exact product(s) to serve this shopper now.

Advertisers Forced to Determine Bid by Product Rather than Query

Worse yet, because of the way PLA campaigns are structured, advertisers are forced to determine bid and budget distribution by product, rather than by query. This forces the advertiser to judge PLA performance by the average of generic, brand-specific and product-specific queries.

For example, if Nike bids $1 on their Air Max 270 React, shown above, then they apply that same $1 bid regardless of whether the user searches for a generic query with little intent to purchase, or a product-specific query with high commercial intent.

If you noticed in my example earlier, generic, brand-specific and product-specific queries all had a similar average CPC – the result of bids being set at the product level rather than for combinations of products and search terms.

This is problematic, as we just determined that the value which queries hold to a business often vary dramatically by their intent. Therefore, it is not possible to maximize PLA profits with the typical PLA setup, where each product is represented once within the account structure, as the advertiser is forced to invest around the average of performance across query segments, rather than breaking them into isolated groups.

This brings me to my next point on how to utilize keywords in Google Shopping/PLAs.

How to Segment Product Listing Ads for Query Intent

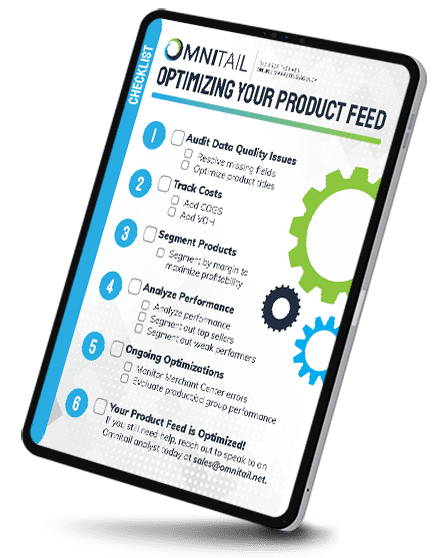

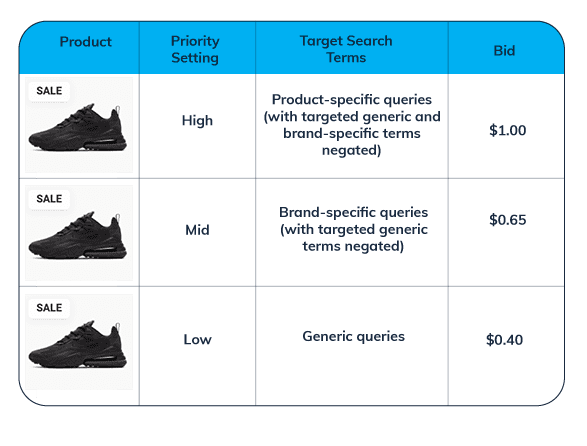

With the introduction of priority settings in Google and Bing shopping campaigns, it is far easier to segment product listing ads by query intent, or any particular terms which you desire to isolate. While some retailers with brand-agnostic products are best suited for a slightly modified taxonomy for segmentation, we typically find isolating product-specific queries, brand-specific queries and generic queries results in the optimal segmentation of traffic.

Essentially, every product lives in at least three separate places within the account – once in a high-priority campaign, once in a mid-priority campaign, and once more in a low-priority campaign. Terms are then negated in order to funnel traffic to the designated priority setting, where bid and budget conditions, even mobile bid adjustments, are determined based upon the isolated performance of the product and search query classification, rather than a blended average of all of them.

While some may prefer to modify the structure slightly, we have found that generic and brand-specific queries are far more evergreen than product-specific queries, reducing the total count of negative terms required to accurately funnel the traffic.

If you wanted to flip our method and target generic terms in the high-priority campaign and product-specific queries in the low-priority campaign, then you would need to identify all of those product-specific phrases ahead of time. This typically results in significantly more unique terms which need to be identified and negated.

Requirements for Implementation: Query Classification/Negative Keyword Optimization

Implementing this strategy will require the advertiser to maintain a regularly updated list of generic and brand-specific terms which are used to funnel traffic. We also recommend keeping a cache of product-specific terms to reduce the time needed for scrubbing your data.

For a very small business with little to no budget for management, you can probably manually classify all your search queries yourself, though it will be a large amount of tedious work. This is actually how we used to do things, prior to automating the process.

Results: How One Retailer Increased Profits 6352%

After segmenting PLAs by query intent, the retailer which I used in my previous example increased profit 6352% within the first 90 days vs the 90 day period prior to segmentation, and a 1416% lift in profit Y/Y. This particular retailer had been grossly overspending on generic queries, and underinvesting in product-specific queries – a result of the limitations of the typical PLA structure.

By isolating generic, brand-specific and product-specific query segments from each other, this retailer was able to bid more appropriately on generic queries, and bid more aggressively on product-specific queries, maximizing impression share and dominating the market for these terms. This level of segmentation changed the dynamic of their PLA search query portfolio, radically increasing profits with little change in total media spend.

Summary

Segmenting PLAs for query intent has proven to yield radical improvements in profitability for retailers of all sizes and across all industries. As this strategy continues to gain popularity it’s reasonable to speculate that query segmentation will, at some point, become mandatory in order to remain competitive in PLAs.

If you’re a retailer and are interested in learning what value this strategy might bring to your business, contact us. I will run a search query analysis for you, classifying your historical search queries as product-specific, brand-specific or generic, and provide a financial breakdown for each of those segments.

For the average $10MM retailer, it takes less than an hour to process these queries with our tool. For retailers with greater than $10MM in annual sales, I can deliver the analysis to you within one to two days.

The analysis is free and non-invasive, so don’t hesitate to reach out, even if you’re just interested in gaining a better understanding of how shoppers search for your products.