This month Google released the Gmail placement for Google Shopping Ads. (For the full update check out our blog, Google Shopping for Gmail: What You Need to Know. )

Today, we are going to look at the impact of this new placement. We talked with Chris Kendall, an SEM strategist at Omnitail, to see how his clients’ accounts have been affected.

Q: Did your clients opt into Shopping ads on Gmail?

We have Google Shopping clients who are opted into display — and that’s all you have to do to start serving Google Shopping ads on Gmail. So, yes we have clients who are now utilizing the new ad placement.

Q: What impact have you seen from this new ad placement?

Well, I can tell you that it hasn’t negatively impacted my campaigns. There are a few factors that make it difficult to understand the full impact. The first is pretty obviously, the current situation with the COVID-19 virus. It’s making data muddy for everyone. You can’t look at last year’s data and compare it to now because it’s just so different.

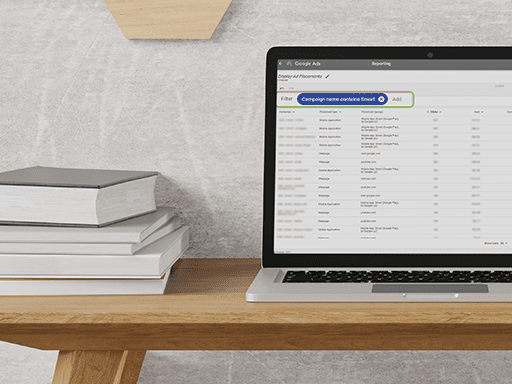

Right now, I am seeing ad spend increase on the Display Network for my clients whose Shopping Campaigns are opted into Display placements, but I can’t say for certain whether that is because of the new placement or due to the current crisis. Here’s a look at the data I pulled…

- In the 2 weeks following March 4 (the release date of the Gmail ad placement), click volume increased by 6% while RPC decreased by 91% for Display placements.

- In the 4 weeks following March 4, click volume increased by 24%, and RPC increased by 30% for Display placements.

I believe that the data from the 4 weeks following March 4th in particular is skewed by current events. This is anecdotal, but at least for my accounts, traffic for Shopping ads really picked up in the latter half of March (especially after the national emergency was declared on March 13).

This surge at the end of March could also be influenced by Amazon pulling out of advertising in the middle of the month.

Q: How is the new placement performing compared to other Display placements?

You can segment by network obviously, so we can look at Display Network compared to Search Network data. Unfortunately, with display ads, you can’t separate it by placement. This means you can’t see if certain locations like YouTube, Gmail, or Discover are performing better or worse than each other.

When I look at the data, I can see something like, “We spent $20.00 on Display Network for this time period”, but I don’t know specifically where these ads appeared — so it’s not very insightful.

Q: How do you think Google could improve reporting for Display Network placements?

In the future I’d like to see Google give more control over reporting like this — obviously I’d like to see Display Network data divided out by placement. Taking it a step further though, I want Google to give advertisers targeting abilities for these different placements. For example, if I find that Gmail is driving a lot of conversions — I’d love to be able to prioritize that placement over YouTube.

Conclusion

As of right now, it’s difficult to see if this new placement has any real impact. As Chris pointed out, current world events combined with Google’s lack of segmentation in targeting make it difficult to glean a lot of insight.

We will continue to monitor our Google Shopping clients who have opted into the Display Network to see if any clear trends arise. For now, we recommend opting in — like Chris said, it isn’t negatively impacting campaigns. If you’ve seen your ad spend rise or have experienced other results, let us know! We’d love to hear what you’ve seen.