Tackling Real World Problems

At Omnitail, we believe strongly in profit-based digital marketing. We aim to maximize the profit, in dollars, for our clients. For most paid search programs, this is done on the segment level (each segment could be an individual keyword, products or product groupings, ad groups, or even whole campaigns)—but how do we extract the greatest profit from each individual segment of the paid search program?

Ultimately the goal is to manage the account as if it were a portfolio, allocating budget precisely to the perfect blend of high-performing segments while minimizing ad spend to under-performing segments. In most cases, everyone is happy—and making money!—in this scenario, but admittedly there are real world problems that even optimizing for profit does not solve for. Excess inventory is such a problem.

Don’t have time to read the blog? Get the quick version in this video:

Excess Inventory and Clearance Items

For example, if a retailer is overstocked on last season’s merchandise, they often mark it as clearance and attempt to sell through the remaining goods at a low margin in an effort to free up cash. If you’re managing ad spend to a traditional ROAS target, you’ll need to adjust your ROAS target to justify spending anything on these items at all. Even with the margin-based, profit-centric bidding approach we employ, adjustments are usually needed.

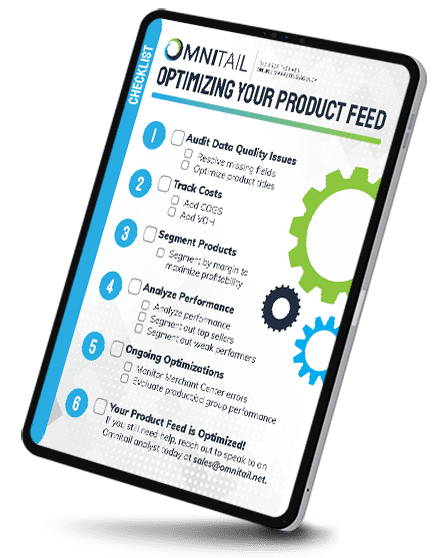

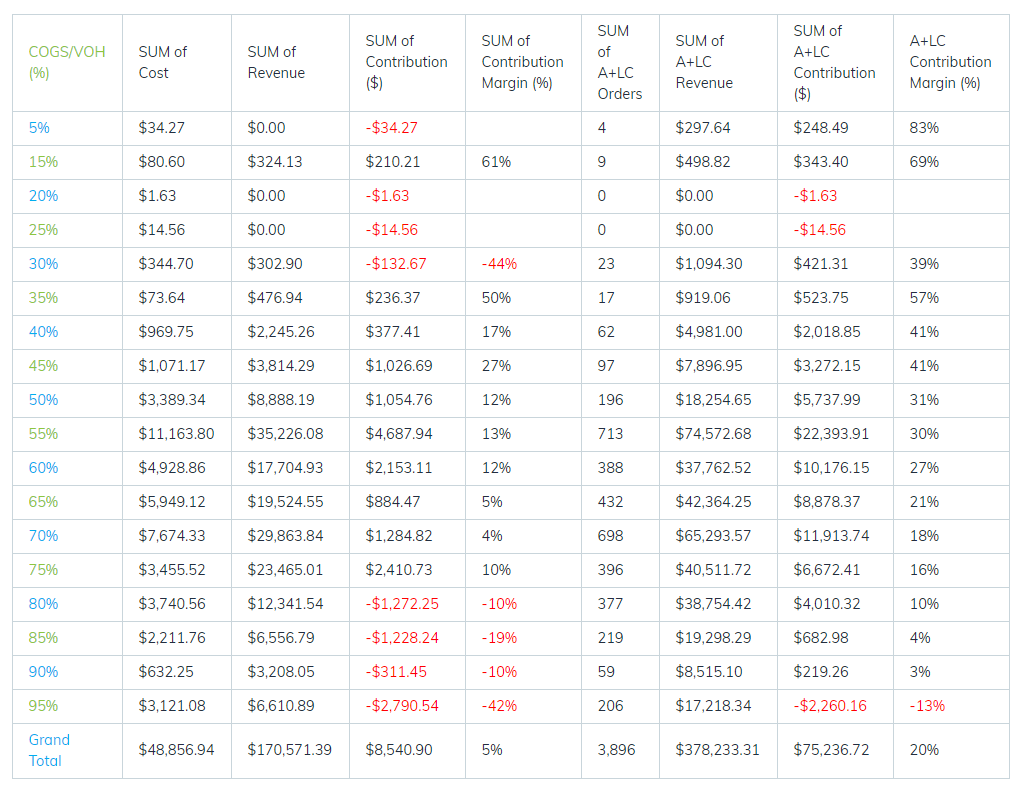

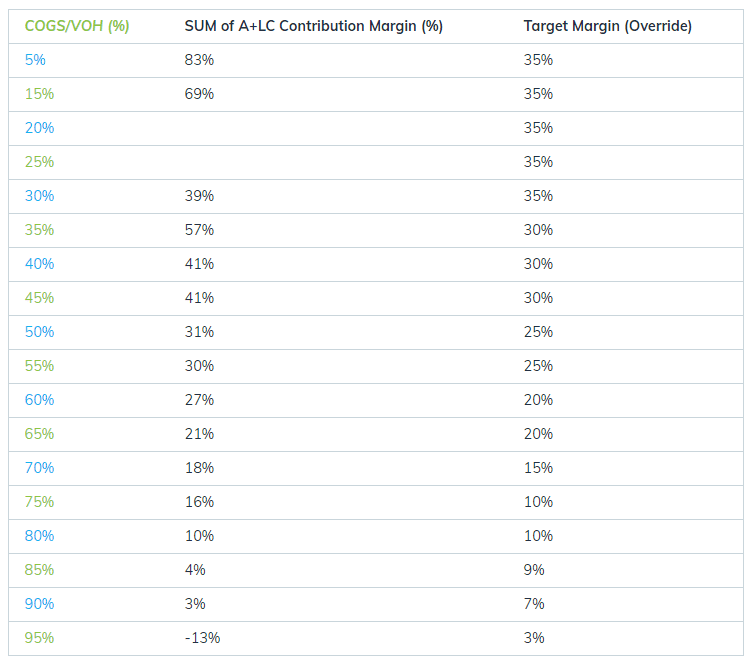

The table below shows actual performance for a client of ours over a 30-day period. The first column shows the cost of goods (COGS) of the items being advertised as a percentage (rounded to nearest 5th), and the following columns illustrate the corresponding performance of these items. We’ve compared performance here on a conservative last-click attribution model, as well as on a more generous assisted + last click model. Contribution dollars are the profit, and contribution margin is the rate of profit.

Clearance merchandise—because it’s priced much lower than average items —is likely to fall into the 90 or 95% COGS tiers. This retailer is very comfortable with zero margin on these goods for the sake of recovering their cash. Because of this change in strategy, we’re able to validate greater spend to these products, something that’s not possible if you a) aren’t taking cost of goods into account within your product segments at all (which many retailers targeting ROAS are not) and b) if you’re applying the same ROAS target to all of your campaigns.

Extracting Maximum Profit

The data illustrates another conundrum—what do you do when there simply isn’t the margin available to meet your target? As I said before, we typically will aim to maximize the profit on a segment level, meaning we aim to extract maximum profit from an item with a 50% COGS independent of an item that has an 80% COGS.

Let’s say we find that maximum profit dollars on 50% COGS items is achieved at a 31% contribution margin. In this scenario, 19% of revenue is ad spend, 50% is COGS, and 31% is profit. We will not aim to spend beyond this point, because that’s where profit is greatest. A 30% margin, 25% margin, etc. are all intolerable in this instance, as total profit would be less than it would be at 31% contribution margin (even if total revenue was greater.)

Now, look at items in the 80% COGS bracket. These items, because they offer only 20% gross margin, can never achieve a 31% rate of profit or even close to it. They simply do not offer enough gross profit to do so. We are limiting our spending to these items on the basis that profit dollars are maximized at or near a 10% contribution margin—where 10% of revenue is ad spend, 80% is COGS, and the remaining 10% is profit.

The business problem in this scenario is that if we spend anything at all on items with an 80% COGS, we’re simultaneously limit spending on items with a 50% COGS to a 31% margin. By definition, an item with an 80% COGS will never achieve the 31% rate of profit our ad dollars already achieve elsewhere in the account, yet we deliberately allocate ad spend to these lower margin items while that same ad spend could yield a greater rate of profit elsewhere in the account. The spend is still profitable in both segments, but there is certainly some opportunity cost to spending that budget on lower margin items.

On the other hand, it is probably not appropriate to spend nothing on these items at all. You can see in this table that while 80% COGS items are less profitable than others, they do account for a larger portion of sales than items with a 50% COGS. Spending nothing on these items can cause other business hardships, such as strained relationships with manufacturers, or even exacerbate the issues with excess inventory. If we’re not allocating any ad spend to these items yet the retailer continues to stock them, we may unintentionally contribute to the need for clearance markdowns in the future.

Overcoming Challenges and Our Solution

I don’t think there’s a right or wrong answer to these issues, and I don’t think any agency is in a position to dictate the solution here. However, I do feel it is important for our clients to understand the business challenges that come with optimizing for margin, and have some ability to influence this situation. Our solution to the problem is to override our bidding strategy and target contribution margin in a more arbitrary fashion when this is a concern. Here’s an example:

The added column in the table above indicates our new target margin. These are somewhat arbitrary and are dictated by the retailer in an effort to 1) spend less on low margin items and 2) redistribute those funds to higher margins items by targeting a lower contribution margin than we would normally aim to achieve. We may not maximize the profit dollars generated across items with a 50% COGS, but the rate of return on a dollar spent will still be substantially greater than if those dollars were spent on low margin goods.

Where AI Falls Short

One last important note: a good agency will help facilitate management of paid search initiatives in a manner that aligns with client needs. As we see more fully automated software and “AI” offerings in our industry, it’s important to remember where these systems fall short. A software system is not going to have a conversation with you about the opportunity cost of maximizing margin on a segment level, or the potential business challenges that come with naturally spending less on lower margin/clearance inventory. An agency in which humans manage the account, however, will—or at least, they should. Read about how Omnitail combines in-house tech and expert knowledge following this ideology in our Omnitail Quick Start Guide.