At Omnitail, it’s no secret we don’t necessarily follow standard agency metrics – like ROAS and A/S. In fact, it’s right in our name: We’re “The Profit-Driven Agency for eCommerce Growth.”

New customers are often surprised to find, though, that the monthly reports they receive don’t contain any metrics labeled as “profit.” Instead, our reporting is built around two other industry metrics: contribution and contribution margin. As we onboard and work with these customers, we’re often asked, “What is contribution margin?” and “How do you calculate contribution margin?”

What is Contribution?

The simple answer is “profit” – or rather, the amount that paid ads as a channel contribute to overall operating profit. Contribution refers to the dollars left over after variable costs like cost of goods sold (COGS), shipping, and ad spend have all been accounted for.

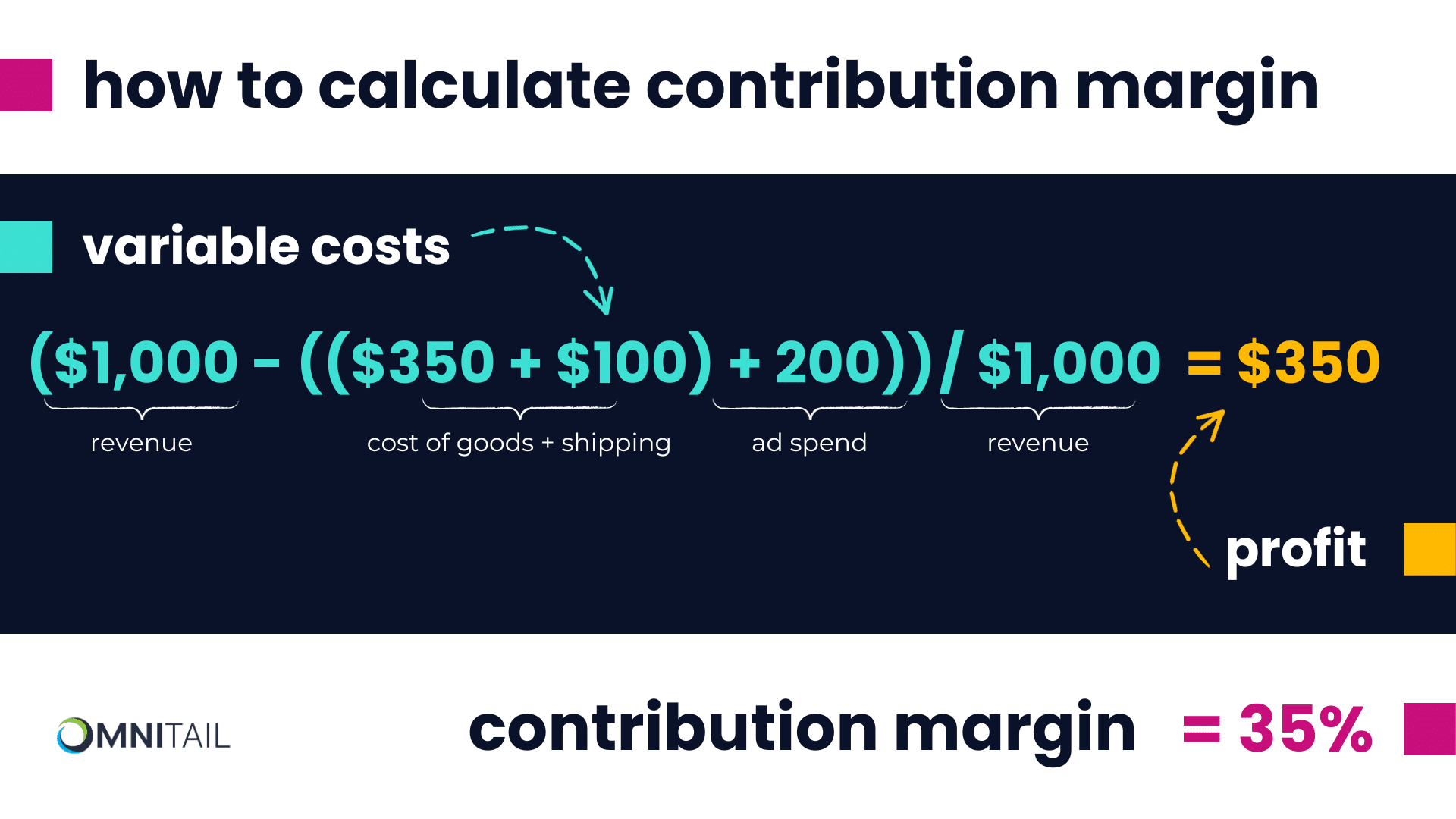

Here’s an example:

You might make $1,000 in revenue from paid ads in a given month. The cost of the goods sold averages 35% of revenue (so for this chunk of revenue, cost of goods sold equals $350), and your monthly shipping costs for sales attributed to paid ads is $100. You’ve also spent $200 on advertising.

Of your $1,000 in revenue from paid ads, you’ll keep $350 as profit, or contribution to your overall operating profit. We use this metric, along with contribution margin, to drive our bidding strategy and make other management decisions about a given account.

What is Contribution Margin?

Contribution margin, also known as contribution rate, is a measure of profit as a percentage of revenue. In the example above, $350 remained as profit (the contribution) from the $1,000 total revenue – a 35% contribution margin. Not bad! The closer to 100% your contribution rate is, the better off you are; however, most contribution margins fall below 50%.

You can also think of contribution margin as the percentage of revenue that contributes to fixed costs after accounting for your variable costs (like COGS, shipping costs, and ad spend listed above.)

Using our example, here is how we calculate contribution margin using the contribution margin formula:

Why Not Use ROAS or A/S?

ROAS (return on ad spend) and A/S (advertising-to-sales ratio) have their place and are still included in our monthly reporting — but we just don’t rely on them alone to measure success and make account management decisions. These two metrics can help inform our decision-making, however.

ROAS

At Omnitail, we use ROAS as a metric to inform decision-making, but not as the only metric to do so. ROAS doesn’t account for other considerations like COGS, variable overhead expenses, return rates, or customer lifetime value (LTV), so it’s not ideal to base your entire strategy around it. But, it can be an informative metric when evaluating the impact of diminishing returns on incremental marketing investment.

Advertising-to-Sales Ratio (A/S)

Advertising-to-sales ratio (A/S) is the inverse of ROAS, and is synonymous with cost of sale (COS) and effective revenue share (ERS). It’s an efficiency metric—not a measurement of profitability— and doesn’t account for the cost of goods sold or variable overhead expenses, so we don’t typically rely on it as a primary key performance indicator (KPI).

Like ROAS, though, advertising-to-sales ratio can be useful in determining the impact of diminishing returns on incremental marketing investment.

Curious about your profitability? Get a free profit analysis today!