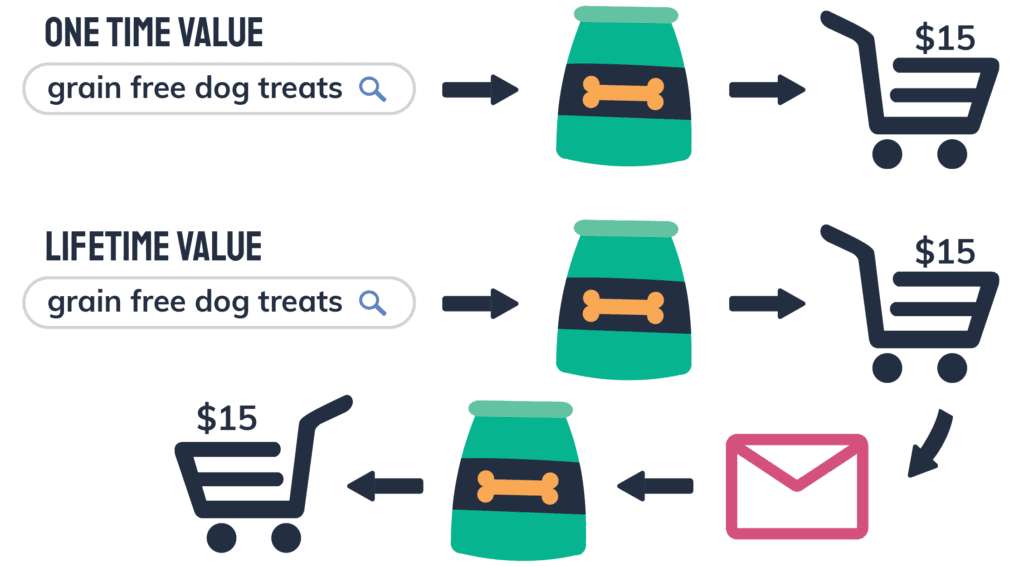

Ask most retailers which metrics they’re using to determine advertising strategy, and they’ll respond with one or more of the following: revenue, profit, or ROAS. For some retailers, though, strategy is best designed around an entirely different metric—customer lifetime value.

Of course, relying on customer lifetime value metrics doesn’t mean you can ignore revenue and profit entirely! The key is to set profit targets that will enable you to also maximize customer lifetime value.

The best way to do that?

By using New Customer Contribution Margin Targets. Let’s take a look at these targets, and how to use New Customer Contribution Margin to maximize long-term profit!

New to lifetime value metrics? Our colleagues at Glew have put together a fantastic, in-depth guide to understanding why lifetime value metrics matter for campaigns, which metrics to use, and how to effectively measure them. Read it first, then come back to see how you can leverage these metrics to drive additional profit!

What are Contribution Margin Targets?

To understand new customer contribution margin, we first need to explore traditional contribution margin targets.

Essentially, these targets represent the percentage of revenue you’d like to keep as contribution (or profit) from a given ad group, campaign, or channel.

- If an ad group, etc is above or more efficient than your target, you can afford to raise bids or spend more.

- If the ad group is below or less efficient than your target, lower bids or pull back on spend.

Contribution margin targets account for both efficiency and sales volume, making them the most precise method of account management. It also includes key factors like cost of goods and variable overhead—giving you a holistic idea of the impact of your campaigns on your revenue and profit.

Contribution margin targets are often based on whole dollar profit. Sometimes, though, retailers are more focused on maximizing new customer acquisition.

That doesn’t mean they can’t utilize a profit-driven strategy!

These targets can be adapted to reflect new customer contribution margin, or profit created by a new customer over time. Let’s take a look at how to adapt a profit-driven strategy to this unique business case.

When Should You Use New Customer Contribution Margin?

For most retailers, metrics like revenue or profit work well for day-to-day management. These retailers don’t see significantly more value from later sales than first-time customers, so there’s no need to direct spend specifically to new customers over returning ones.

In this case, lifetime metrics are primarily valuable for long-term strategy questions. They can help you determine which channels drive repeat customers and/or high-value customers, so you can make broad strategic decisions to prioritize them.

For other retailers, though, it makes sense to drive even short-term strategy by LTV. Often, a new customer for these businesses will go on to make a number of future purchases—so they have a substantial lifetime value. The true benefit of acquiring a new customer (i.e. considerable revenue from recurring sales) isn’t fully represented by short-term metrics.

These retailers need a way to consider this extra benefit when measuring a campaign’s success—and when allocating ad spend. That’s where new customer contribution margin comes in!

Using LTV to Choose a Target

To choose a new customer contribution margin target, you first need a way to measure lifetime value of a new customer, on the campaign, ad group, or channel level. Glew offers a way to gather accurate lifetime value data on a granular level over time—see their blog post for more details!

Once you have your lifetime value metrics, you need to determine how much you’re willing to spend to acquire these new customers. You should base this not only on your lifetime value metrics, but also any relevant cost of goods or variable overhead data. This will also likely differ some for every advertiser based on how aggressive or conservative you choose to be with your spend.

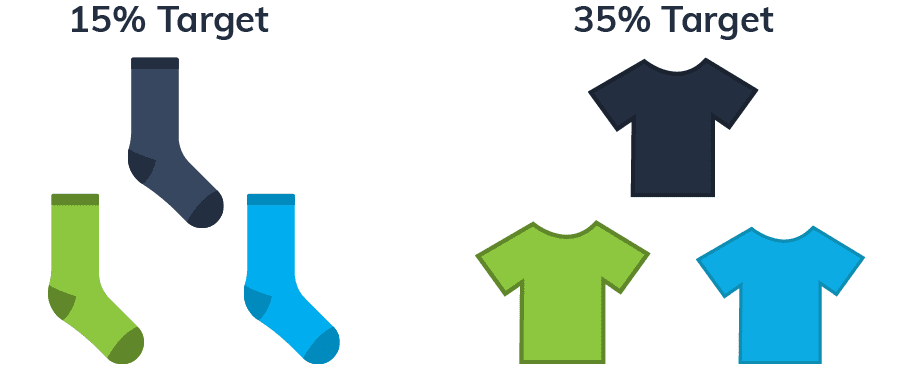

How granular you choose to be with these targets depends on your data, and how you typically manage your ads. You might find that lifetime value differs substantially based on the product segment, in which case you should set different targets for each. These segments may correspond to campaigns or ad groups in your account, depending on how the account is structured.

Either way, you should now have a benchmark, or new customer contribution margin target, in mind for each ad group or campaign: whether each has its own target or you’re using a broader, overall target. The last step is to factor this target into your management!

Managing Campaigns to Maximize New Customer Contribution Margin

Track your campaign or ad group performance relevant to your contribution margin target. You’ll need to calculate the profitability of each ad group or campaign, including relevant factors like cost of goods and variable overhead.

Once you have your actual contribution margin, compare it to your target, and adjust accordingly. Increase spend to those segments that are exceeding the benchmark, and decrease spend to those that are not.

You also need to revisit these metrics regularly to ensure you’re still using an accurate benchmark. For example, your new customer contribution margin may cause you to raise bids on some ad groups or campaigns. However, that extra spend may or may not be driving customers that increase LTV (hopefully so, but not a guarantee!) Checking these metrics every so often ensures you’re still using a target that will maximize new customer acquisition and grow the program: without inadvertently destroying long-term profitability.

Other factors like changes to product line or pricing can also affect your LTV metrics, so make sure to update your targets any time major changes occur.

Using new customer contribution margin as a metric to drive strategy isn’t right for every retailer. It works best for those that have customer value that isn’t well-represented by traditional metrics like short-term profit or revenue.

If your business fits this mold, though, managing to meet a new customer contribution margin target can not only grow sales and profit in the short-term. Combine these targets with a solid campaign strategy, and see how dramatically your profit increases over time!

To see why lifetime metrics matter in advertising strategy, which metrics to use to effectively track customer lifetime value, and how to access those metrics, check out this blog post from our friends at Glew!

Reach out to our team to learn how our Shopify Integration can help you improve your marketing strategies around customer lifetime value.