The Journey to Success with Google Shopping

Creating profitable Google Shopping ads is a process that requires all aspects of your Shopping campaigns to work together in harmony. To guarantee success, we recommend polishing your foundation, strategy, and performance tracking—and not letting any of these important components fall to the wayside.

A successful Google Shopping strategy begins with an error free product feed (this is the foundation of your entire account!) After optimizing your product feed, product segmentation is a must and is crucial for driving the appropriate amount of spend to your products.

Query segmentation is the next step to success. You will want to pull and analyze your historical search terms, build negative keywords lists, and create a three-tier system for queries that aligns to your product categories you’ve just created. Lastly (and probably most importantly) you need to accurately track your campaign performance – to fix what’s not working, and capitalize on what is.

3. Create negative keyword lists

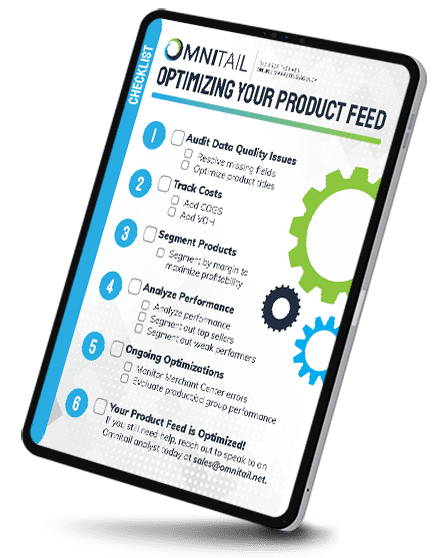

1. Clean Up Your Product Feed

A well-organized product feed is the best foundation for profitable Google Shopping campaigns. While errors at this level may appear to be minor, they can have a major impact on the success of your account. Start by fixing those small errors to ensure all of your products are eligible to serve. Next, scour your account for missing data such as category-specific information.

After fixing errors and missing data, you can start optimizing your product feed. Take a look at your titles, descriptions, and consider how to account for variants. The final step is syncing your product feed to Google Merchant Center.

STEP 1: Fix Common Data Feed Errors

Simple data errors can easily sink an account. Pricing is a common one. If you’ve introduced sales pricing or if your prices have changed, and those changes are either not reflected in the feed in Merchant Center, products will be disapproved and your account may be warned. Same goes for shipping changes – you cannot advertise free shipping if in fact there’s a charge to ship products.

Stock status is another big factor. Products do sometimes sell out quickly – but there’s no excuse for continuing to advertise products that have been out of stock for days or even weeks. Updating stock status regularly ensures ad spend stays with products that can be purchased by the customer.

We also sometimes see clients that have incorrect or outdated images or links associated with products. This issue can send conversion rate spiraling, as customers often don’t wish to purchase an item that represented differently on the site than in the ad. Dead links are even worse – customers can’t purchase anything from a 404 page!

STEP 2: Add All Necessary Data

Data errors go beyond incorrect or mismatched information. Sometimes, data is missing altogether – and that can be disastrous for advertising.

Every feed needs to contain the required fields for Google Shopping. These include the obvious suspects like title, product URL, and price, but also include attributes like brand and imagery. Certain products require additional information, including color, size, or condition. Bundles and multipacks are also treated differently and require some additional attributes in the feed.

Important note: All of the above is pertinent to the US. Feeds for sale in other countries may be subject to still further requirements, depending on local regulation.

There are a number of other fields that aren’t required by Google – but that you should absolutely use to segment and optimize your feed. Ensuring these attributes have consistent, up-to-date information goes a long way toward building a profitable Google Shopping strategy. We’ll cover product segmentation more in depth in the next section!

STEP 3: Optimize Your Product Feed

Once you’ve got all your products in the feed, and you’ve ensured the accuracy of all the data, it’s time to optimize.

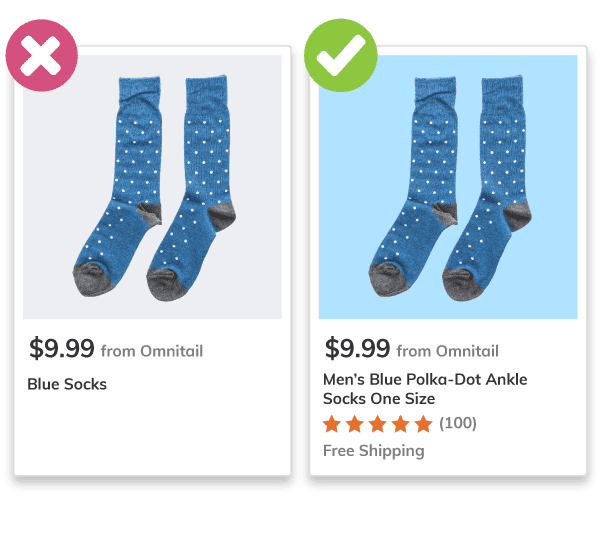

Titles and descriptions are an easy place to start. It’s helpful here to have an idea of how your customers search for your items – check the list in Google Ads to find out. Once you’ve got that information, consider reworking the title or description to better resonate with your customer base. There are limits to this, obviously – you still need these attributes to be readable and within the appropriate character limits.

Products like clothing, snack food, and furniture often have a lot of variants based on color, size, flavor, or pattern. If your products fall into one of these categories, you should ensure each and every variant has its own unique URL. Google uses landing page URL as the factor to determine unique products – so if all of your products of a certain parent SKU share a landing page, only one will be eligible to serve for a given term. This can greatly limit impression share.

STEP 4: Sync Your Product Feed Data

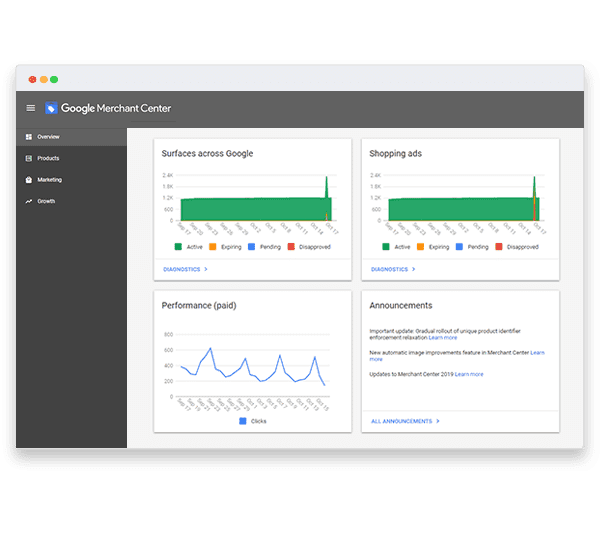

Honestly, this is where most of the issues we see related to #1-3 arise. Often, the data is perfectly up-to-date and accessible on the site, but relevant updates and changes have failed to make it to the product feed. Google Merchant Center is then operating with a bad or out-of-date data set – causing mismatches in data and a whole host of other problems.

We recommend syncing the feed at least daily, if only to keep stock status and pricing as accurate as possible. Checking Merchant Center also puts you in a much better position to catch and fix errors promptly, before they can result in account warnings or even suspension.

2. Segment Your Products for Google Shopping

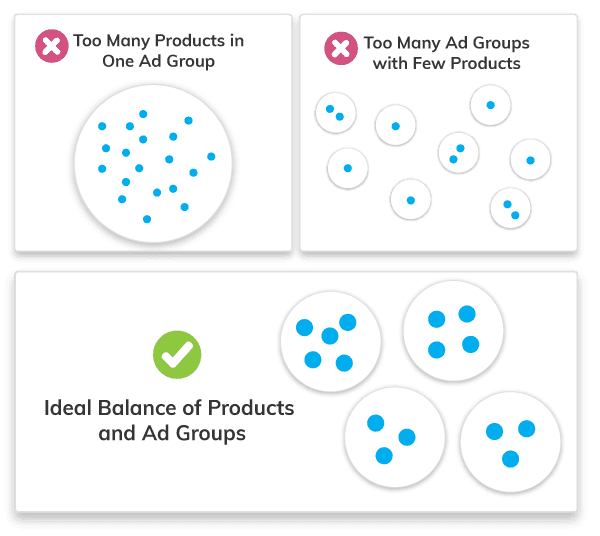

The one universal rule for product segmentation in Google Shopping: don’t go too big, and don’t go too small. Many retailers lump every product into one or maybe two ad groups (in fact, Google recommends this strategy for its Smart Shopping campaigns.) Unfortunately, this isn’t a good strategy. Pushing too many products into a single product group seriously limits your ability to make data-driven decisions on your advertising. You’ll have a very limited ability to drive spend to the segments that are actually creating sales, and will have even less power to control spend on items that don’t convert.

Likewise – you don’t want to segment your products too tightly. Doing so will give you a very small sample size for most products, making it extremely difficult to decide what’s working, and what isn’t. After all – it’s hard to decide based on two or three clicks whether a product should acquire more spend or not!

Other than the universal rule, the rest is up to you. What’s important to measure, for your business? Which segments make sense, given your product lines and customer purchase behavior? Perhaps you should segment by brand, or by category. You can also introduce historical sales data to segment out top sellers or weak items, to direct spend in a way that makes sense for those products. Directing spend with intention is the best way to ensure a profitable Google Shopping strategy.

3. Use Negative Keywords in Shopping Campaigns

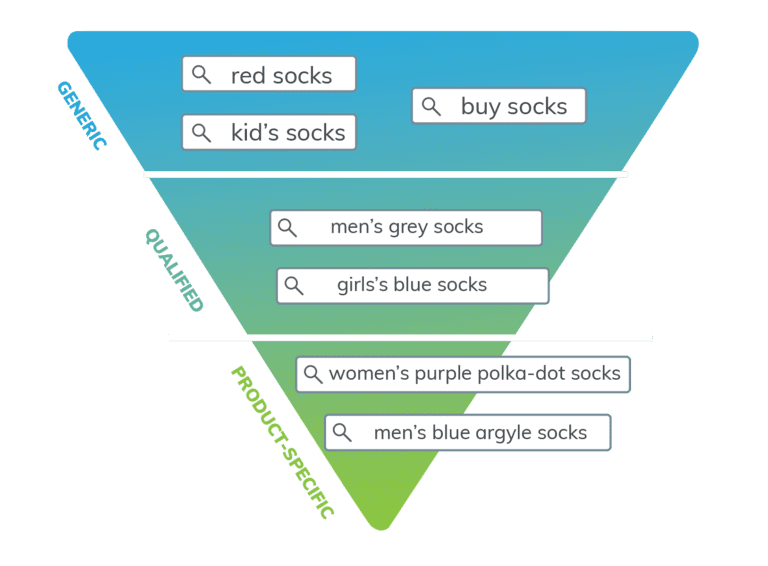

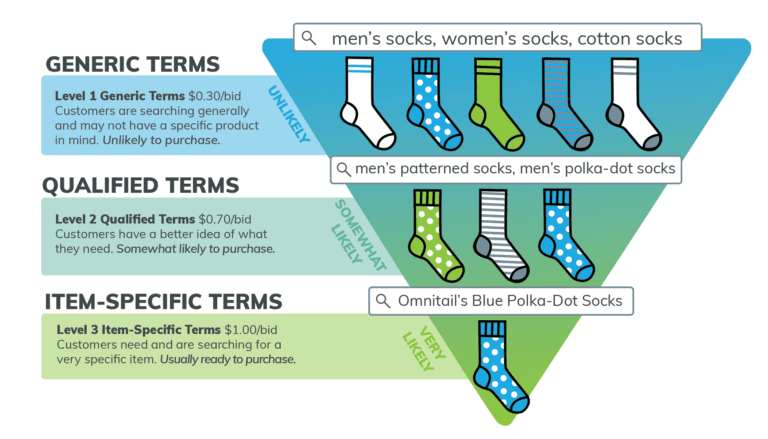

Segmentation is a two-pronged approach. We’ve covered product segmentation, which is the first piece of the puzzle. The second piece is query segmentation (or segmentation by query intent.) The premise is simple. Take a list of your search term data and divide the queries into three categories: generic, qualified, and product-specific. For example you might make the designations in the chart to the right.

Sounds easy, right? Not necessarily, if you’re talking about thousands (or even hundreds of thousands) of search terms! There are a number of ways to accomplish this. You can do it manually (although as we mentioned above, this is going to be an essentially impossible task for midsize or large retailers.) You can also use an ngram analysis, which splits keywords into categories according to likelihood of conversion. At Omnitail, we use a set of in-house tools designed especially to segment queries quickly and effectively.

This process is crucial to our three-tiered campaign structure, which we’ll cover in the next section!

4. The Best Google Shopping Campaign Structure

At Omnitail, we advocate for a three-tier Google Shopping campaign structure. Ideally this aligns to the segmentation you’ve already created above. For example, you could use a different campaign for each of your product segments, and apply the three tiers as a representation of query intent.

At Omnitail we divide query intent into generic, qualified, and item-specific terms. Generic terms are least likely to convert because they show less purchase intent. Someone searching for “men’s socks” is less likely to buy your specific item than someone searching purposely for an item-specific term such as “omnitail men’s blue polka-dot socks”.

Using these three tiers, you can direct spend according to the the likelihood of conversion—bidding more on item-specific terms, and less on generic.

5. Track the Right Metrics

Having a great product feed, a top-tier campaign structure, and a robust set of negative keywords is a great start toward profitable Google Shopping ads. However, all these will mean absolutely nothing if you’re not accurately or meaningfully tracking your results. Here are some commonly used metrics for tracking success in Google Shopping: Ad Spend, Revenue, Conversion Rate, Cost of Goods, ROAS, and Profit.

Out of all of these metrics, ROAS is the most common metric used to manage ad accounts. However, we advise against using ROAS to track your progress.

One metric is the key to success: Profit. It’s the only metric that accounts for both sales volume and efficiency—and the only one that will help you maximize the impact of your advertising campaigns. Why do we put so much store by profit? Read on to find out.

Pretty much anyone who’s taken a 101-level business course has encountered this equation.

It’s not much more complicated in advertising. We often call this metric contribution, to denote that the amount here is the amount contributed by our channel to overall operating profit – but the concept remains the same. The complication begins in accurate tracking, and in tailoring this metric to your business. You need an accurate way to track both costs and revenue, and an understanding of how your advertising impacts each of those metrics.

For online-only retailers, Google Analytics’ Ecommerce tracking is a great solution. Connecting Google Analytics to Google Ads will give you sales and revenue data on the campaign and ad group level. For hybrid or brick-and-mortar retailers, it’s tricky. Many organizations use third-party software to measure the impact of their ads on phone sales, or even on store visits. Although it’s not ideal, you could also develop an informed assumption for sales lift due to advertising, and apply that to your metrics and reporting.

Will profit-driven management work for items that don’t have much available margin?

Absolutely! While most retailers obviously want to preserve margin on most items, clearance or discount items are an exception. In this case, it’s sometimes better to sacrifice available margin to limit losses. We cover how to drive profit on clearance items in a blog post – check it out for more details!

Why Shouldn’t You Use ROAS?

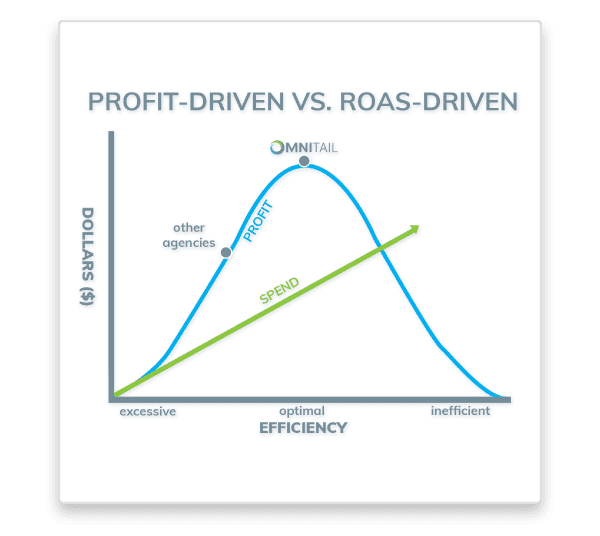

ROAS is easily the most common metric used to manage ad accounts. Plenty of agencies choose a target and stick with it – and won’t deviate from it, even when doing so would create additional revenue. What do we know that they don’t?

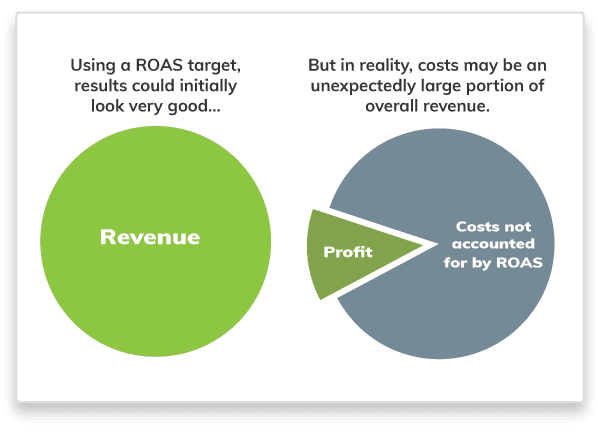

1. ROAS doesn’t account for cost

ROAS does not include key business metrics like cost of goods, shipping or payment processing fees. Using it gives you a skewed view of ad performance. You can have fantastic ROAS results (10x or more!) and yet have little to no profit, if that remaining revenue is being chewed up by cost of goods or other factors.

Scenario: You’re running a Google Shopping program that’s driven $12,000 in revenue on $1,000 in ad spend, for a 12x ROAS. That looks great on paper, but in reality, costs are eating 70% of your revenue. Because you’re not tracking any of these costs relative to your Shopping campaigns, you don’t really know how your marketing impacts your business – or whether you should increase or decrease spend.

2. ROAS results in inefficient ad spend

Most agencies who use ROAS unwittingly end up doing one of two things: improperly limiting ad spend, or wasting money on inefficient advertising —especially once costs are accounted for, Check out this example to see why:

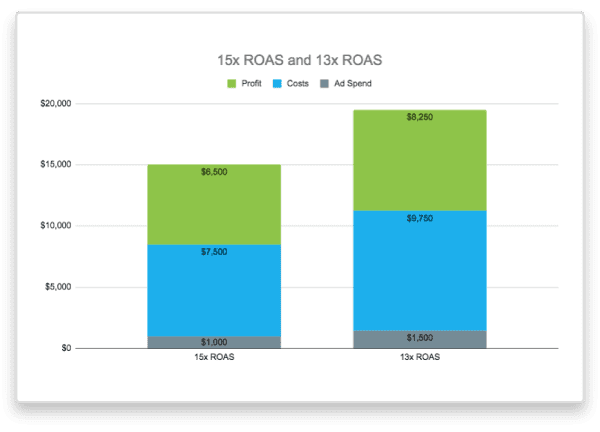

Scenario 1: Let’s assume you have $1000 in ad spend, with a 15x ROAS, resulting in $15,000 in revenue. That looks really good on paper – but what you aren’t accounting for is your costs. If your costs measure roughly 50% of revenue, then you’re really taking $6,500 as profit by the time those costs and your ad spend are accounted for.

Scenario 2: On the other hand, budgeting $1500 in ad spend might net you $19,500 in revenue (so a 13x ROAS). At the same cost, you’re taking home more than $8,000 after accounting for cost of goods and ad spend.

Most agencies stick firm to the target – and never realize that a slightly higher ad spend and lower ROAS may just create incremental profit gains.

3. ROAS isn’t a whole-dollar metric

ROAS is essentially a comparison – how much revenue are you making, compared to ad spend? It won’t offer you a concrete understanding of how much your ads are contributing to your business. It also can’t accurately tell you whether more spend will increase revenue and profit, or if you’re overspending as it is.

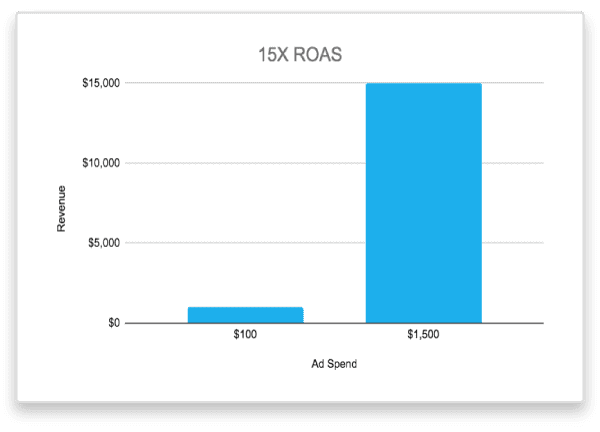

Scenario: A business with $150 in revenue and $10 in ad spend has a 15x ROAS – the same as a business with $15,000 in revenue and $1,000 in monthly ad spend. One is obviously having more of an impact on the business than the other – and is almost certainly generating more profit, too.

Need help managing your Google Shopping campaigns?

Our expert analysts can optimize your product feed, organize your ad groups, and track your performance. Reach out today for a free analysis of your current campaigns.